Value investing: a short and simple explanation.

Value investing is an investment strategy which consists simply of purchasing shares whose price is lower than their intrinsic value. The idea is to take advantage of the undervaluation of the market to realize a long-term capital gain.

Sounds easy, right? Damodaran used the term “investing for grown ups” to explain and caricature that type of investing since you need to have a certain maturity to perform that strategy, in opposition to a childish investing strategy which could consist in fast gains appetite and a short temper.

Value investing has a long and rich history, dating back to the 1930s, when Benjamin Graham and David Dodd wrote the classic book, “The Intelligent Investor”. Graham and Dodd advocated for a conservative and disciplined approach to investing, based on rigorous analysis and a margin of safety. They also distinguished between two types of value investors: passive and active. Passive value investors buy a diversified portfolio of cheap stocks and hold them for the long term, while active value investors look for special situations, such as mergers, spin-offs, or restructurings, that can unlock value (see You can be a stock market genius: (even if you’re not too smart) : uncover the secret hiding places of stock market profits from Greenblatt).

Therefore, value investing is based on a few key principles on which I will expand on further below:

Fundamental analysis: this involves studying the financial statements of the company, its profitability, its growth, its competitive situation, its capacity to generate cash flow, its value of assets and every fundamental data at your disposition to be able to determine a correct intrinsic value of the company, which may be different from its stock market value. This search & read process is what is going to allow you to confirm if the company is worth your investment or not, this is how you become familiar with the business and its long term viability, therefore convincing you that you do not need to look at the stock price for the next five years if needed.

Inefficient market theory: Value investing is based on the idea that markets make mistakes, and that some stocks are priced below their true value. Value investors try to exploit these mistakes by buying undervalued stocks and holding them until the market corrects itself.

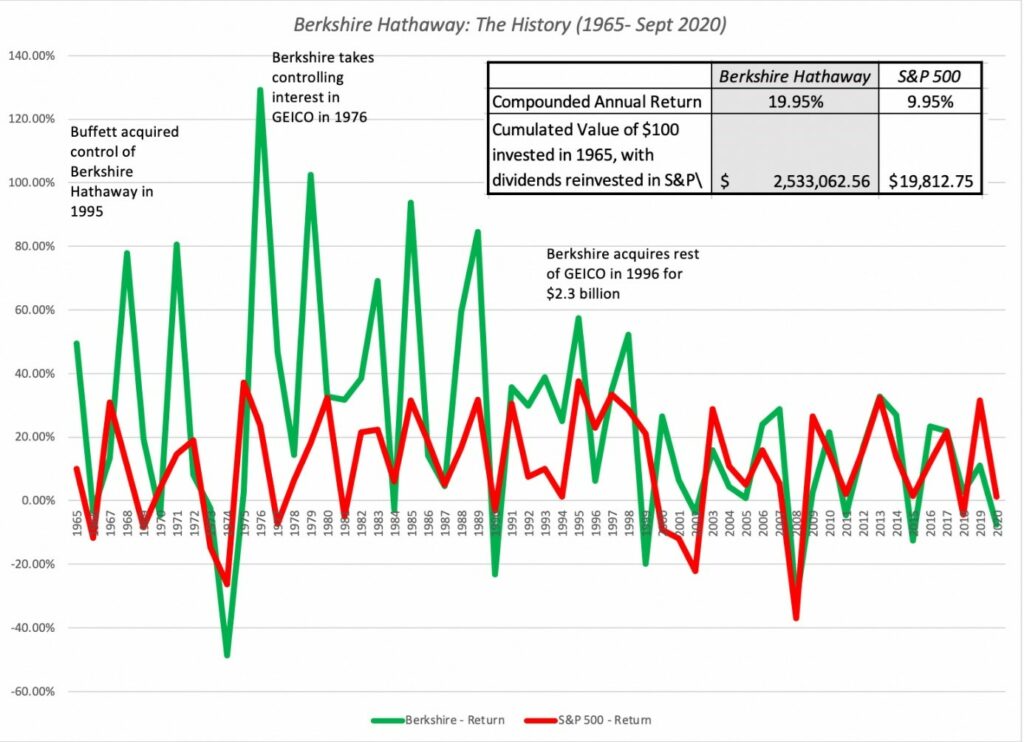

Berkshire Hathaway, Buffett’s company, is a classic example that the market can be inefficient in its ability to properly estimate the value of stocks, and it can be highlighted in this graph: Berkshire Hathaway has been to able to compound an annual return on sixty years which beats the S&P 500 (commonly used index to represent the US Stock Market), proving the point that abnormal returns can be generated using that specific strategy.

The margin of safety: this is the difference between the purchase price and the intrinsic value of the action. The higher the safety margin, the lower the risk of losing money. The value investor seeks to purchase stocks with a sufficient margin of safety to protect against market fluctuations and valuation errors which are unfortunately very common and need to be taken into consideration as part of the value investing strategy.

Time: value investing is a long-term strategy, which requires patience and discipline. Value investors do not allow themselves to be influenced by short-term market fluctuations but focus on the long-term performance of the company. It waits for the market to recognize the true value of the company and for the stock price to adjust accordingly.

While I am certain that value investing is the right way to invest for a logical and calm individual, it is important to mention that stories of value investors and their winning stocks backed up by numbers on how well value investing does, relative to other philosophies, are not sufficient to highlight that you can identify as a value investor and still fail.

That is why, it is of the highest priority to spend enough time studying this school of investing in the hope that you can one day, in the best scenario: challenge compounded annual returns from legendary investors. And in the worst scenario: not become a failed investor and lose parts of your capital.

Calling yourself a value investor, like many things in life, must be deserved through the means of hard work and mistakes well learned.

01/17/2024