Is NVIDIA (NVDA) overvalued? (spoilers: Yes)

First, I would like to say that I personally enjoy NVIDIA products on the basis that their GPUs are a product that I am familiar with, and it has been the case for probably more than a decade. Now, my experience with their products is quite simple: premium quality for a high price. Does the price reflect the true value of the product? My opinion would tend towards a no, even if I do enjoy their products and ability to innovate in the gaming atmosphere.

Anyway, if I wanted a price/value GPU, I would prefer to look into AMD’s, but that’s only my two cents on the subject and from what I know, that simple statement could truly cause mayhem on Tech forums and has been a debating matter for quite some time.

Now that you know that I am not biased towards NVIDIA and that I look at the company with a critical eye, you can understand that I’ve watched it develop marketing strategies to push their new GPUs at colossal prices and justifying them by highlighting that the ray tracing performance, DLSS, and cost-energy ability are sound arguments that establish the price as worth it.

I do understand and respect their alignment, nonetheless past lessons concerning the company have taught me that they are accommodated with empty promises. When I say promises not respected, I particularly think about those last booming years concerning the demand of GPUs, and the fact that shareholders were convinced by press releases and communications that NVIDIA would capitalize on that demand to increase sales volume and adjust overall prices to be more accessible (and align more with the price to quality ratio).

You are probably asking yourself, if this article is a stock analysis of NVDIA in the era of AI, why am I even bothering about talking about GPUs and miscommunications?

Because gaming GPUs used to be their main segment, and that the communication on their ability to align to the demand is something that has been concerning and one could think that the market may have overvalued the capacity of NVIDIA to adapt enough to cover the demand for Artificial Intelligence products and potential applications.

One could even go further and see it the contrarian way: is there a possibility that the overall sentiment concerning AI technologies might be slightly too optimistic ?

Here are some potential reasons why the demand for AI might not be as massive as it is expected to be:

- Hype and Speculation: There could be excessive hype and speculation surrounding AI technologies, leading to inflated expectations of its capabilities and market potential. If this hype is not met with corresponding tangible results or if the technology fails to deliver as expected, it could lead to a correction in valuations.

- Uncertain ROI: While AI has immense potential to transform industries and drive innovation, the actual return on investment (ROI) from AI projects may not always meet expectations. If companies invest heavily in AI initiatives without achieving the desired outcomes, it could lead to skepticism about the actual value and sustainability of AI technology.

- Market Saturation: As more companies enter the AI market, competition intensifies, leading to saturation in certain segments or oversupply of AI solutions. This could drive down prices and margins, making it challenging for companies to justify high valuations based on AI-related revenues alone.

- Regulatory and Ethical Concerns: Concerns about data privacy, algorithmic bias, and regulatory scrutiny could dampen the growth prospects of AI technologies. If regulatory constraints increase or public sentiment shifts against AI due to ethical concerns, it could hinder the adoption and commercialization of AI solutions, impacting their perceived value.

- Technology Limitations: Despite significant advancements, AI technologies still have limitations and challenges to overcome, such as robustness, interpretability, and scalability. If these limitations become more apparent or if breakthroughs in AI research fail to materialize as expected, it could temper enthusiasm and valuations in the AI space.

- Economic Downturn: Economic downturns or global uncertainties can affect investment priorities and discretionary spending on AI initiatives. If companies prioritize cost-cutting measures over long-term strategic investments during economic downturns, it could slow down the growth of the AI market and lead to reevaluation of its valuation.

For an interesting approach on the subject, I consider that it would be considerably of value to compare the stock market boom related to AI (Artificial Intelligence) to the boom and subsequent crash of the internet bubble in the late 1990s and early 2000s.

As you know, during the late 1990s, there was an extraordinary level of hype and speculation surrounding internet-related stocks. Many companies with little to no profits experienced exponential stock price growth based on the expectation of future profitability.

Similarly, there has been significant hype and speculation surrounding AI technologies, with investors pouring money into companies involved in AI development, regardless of their current profitability or revenue streams. The promise of AI to revolutionize industries has led to high valuations for AI-related stocks, which may mean one thing: to this day, is the market properly valuating NVDIA?

You certainly understand that valuations of internet stocks reached unsustainable levels during the late 1990s, with price-to-earnings ratios soaring to astronomical heights. Many companies were trading at valuations that far exceeded their intrinsic value.

AI Boom: Similarly, valuations of AI-related stocks have reached elevated levels, with some companies trading at high price-to-earnings ratios relative to their earnings potential. Investors are often willing to pay a premium for exposure to the potential growth of AI technologies.

Investor Behavior:

Internet Bubble: During the internet bubble, investors exhibited speculative behavior, chasing high-flying internet stocks based on momentum rather than fundamental analysis. Many investors were focused on short-term gains rather than the long-term viability of the companies they were investing in.

AI Boom: In the current AI boom, there is also a degree of speculative behavior, with investors flocking to AI-related stocks based on the promise of future growth and technological innovation. However, there is also a greater understanding of the underlying technologies driving the AI revolution, leading to more informed investment decisions.

Market Correction:

Internet Bubble: The bursting of the internet bubble led to a significant market correction, with many internet stocks experiencing sharp declines in value. Companies with weak fundamentals and unsustainable business models were particularly hard hit, leading to widespread investor losses.

AI Boom: While there may be concerns about the sustainability of current AI-related valuations, it remains to be seen whether there will be a similar market correction as experienced during the internet bubble. Factors such as continued technological advancements, regulatory developments, and broader market trends will influence the future trajectory of AI-related stocks.

Overall, while there are similarities between the stock market boom related to AI and the internet bubble, there are also significant differences in terms of the underlying technologies, market dynamics, and investor behavior. It’s essential for investors to conduct thorough due diligence and consider the long-term fundamentals of companies when investing in AI-related stocks.

Based on these considerations, it’s possible that even if NVIDIA’s last earnings are very impressive, the market price may not fully capture its intrinsic value due to factors such as overly optimistic expectations, market sentiment, or speculative trading. Therefore, it is our job as investors to conduct a comprehensive analysis beyond just earnings figures to make informed decisions about the stock, and finally decide if the stock is currently overvalued because of wrong assumptions about the future and/or if it is because the stock has become a vehicle for craziness, meaning that it is just a matter of time before the bubble blows up.

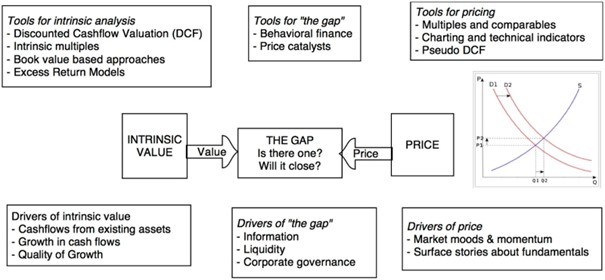

As we understand the distinction between Price and Value, the concept that the stock price could greatly deviate from the true value of the stock is something that, as value investors, we truly dread in the measure that it could be symptomatic of the stock being played around by irrational investors. It means that as good as your valuation is, it could be discarded by the market’s folie of grandeurs, and means that as a value investor, you have no edge against those odds. Therefore, it is of much importance to understand which drivers are moving the stock. The gap, as exposed in Damodaran’s illustration, must be analyzed to decide if that gap might be too important for our taste, and in the case of NVDIA, it is my opinion that the gap is getting bigger and bigger, and that the current price of the stock is mostly driven by momentum and accrued optimism.

Nonetheless, it is still required to value the intrinsic value of the company to prove my point, and add that last point to the multiple reasons allowing me to safely claim how unsound the market has become concerning NVIDIA.

Obviously, this is my model, using my own assumptions so I totally advocate for you to do your own valuation but without any surprises, the stock is overvalued by a lot and does not follow fundamental analysis. I have to mention that this valuation follows optimistic growth rates expectancies and that still does not justify a valuation at 792$ per share.

From what I can tell, the market expects more of an growth rate around the 40% which will slowly degrades around the 4% range in the next decade, taking the optimistic road a little too far in my opinion.

Finally, I want to conclude in stating that while, as value investors, we only play around with what we know, meaning that our approach tries to be as close as reality as we can, and that the only truly analystic tool that we dispose is our fundamental analysis, NVDIA is an interesting case study of valuation being ignored by the market. Meaning that this stock is probably not living under normal rules anymore, and is subjected mainly to speculation, while totally ignoring the fundamental nature of intrinsic value and future cash flows.

As Graham said, in the short run the market is a voting machine. Right now, that gap is truly imposing itself as the market has been “saved” by NVIDIA, but in the future the weighing machine will show if the valuation that the market has made about the stock is accurate or not, or if this reality will be ignored. And even if the gap Price vs Value close itself or not, is there a future in which we are going to witness an exceptional example of fundamentals being ignored in the valuation process, pushing the stock to the moon?

At this point, either the market has unrealistic expectations concerning future cash flows, either the stock has become a vehicle for speculation and crazyness. In either case, I’ll never engage in owning stocks that maintain their route in this area of uncertainty. Recognizing that sometimes you don’t have an edge is an important lesson.

The time will tell us if I was right or not on the subject and if an AI bubble has taken place, but my rational perspective on the subject is that NVIDIA’s share price is long due for a correction, but as I said, time will tell.

CB

02/29/2024